washington state capital gains tax 2020

This percentage applies if you make more than 434550 for single. The Washington Capital Gains Tax to Fund Education Initiative was not on the ballot in Washington as an Initiative to the Legislature a type of indirect initiated state statute.

How High Are Capital Gains Taxes In Your State Tax Foundation

The Combined Rate accounts for the Federal capital gains rate the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations on itemized deductions which increases.

. OLYMPIA WA Washington state is set to create a new capital gains excise tax. New Hampshire doesnt tax income but does tax dividends and interest. Washingtons legislature passed a new capital gains tax in April Engrossed Substitute SB.

Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments. Inslees 21-23 capital gains tax proposal. Filed by the Washington and American Bankers Associations last year the lawsuit concerns the states 12 business and occupation BO tax on banks earning 1 billion a.

To see what Gov. Once implemented Senate Bill 5096 will. Jay Inslee on Thursday unveiled a budget proposal for 576 billion in general fund spending and a capital gains tax for the 2021-23 biennium.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Ad Make Tax-Smart Investing Part of Your Tax Planning. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try.

Washington state recently enacted a new capital gains tax set to begin January 1 2022. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Over 85 million taxes filed with TaxAct.

Also keep in mind that in the state of Washington the most you can be taxed is 20 percent on your home sale. Starting January 1 2022 the State of Washington will impose a seven percent tax on money earned from the sale or exchange of long-term capital assets otherwise known as. Washington Enacts New Capital Gains Tax for 2022 and Beyond.

Ad Import tax data online in no time with our easy to use simple tax software. Includes short and long-term Federal and. CLAs state and local tax team can help you evaluate and plan for Washington capital gains tax impacts.

Easy Fast Secure. State of Washington that the capital gains excise tax ESSB 5096 does not meet state constitutional requirements and therefore is unconstitutional and invalid. Read this guide to learn ways to avoid running out of money in retirement.

Washington state capital gains tax 2020 Sunday February 27 2022 Edit Lawsuits challenging Washingtons new state capital gains tax on the wealthy seek to re-rig our tax code. Beginning January 1 2022 Washington state has instituted a 7. This information relates to a capital gains tax as proposed in 2018.

Taxes capital gains as income and the rate reaches 66. Senate Bill 5096 Concerning an excise tax on gains from the sale or exchange of certain capital assets was passed by the Washington Legislature on April 25 2021 and. Governor Inslee is proposing a capital gains tax on the sale of stocks bonds and other assets to increase the share of state taxes paid by Washingtons wealthiest taxpayers.

Jay Inslee has signed bills creating a new capital gains tax on wealthy Washingtonians and giving a tax rebate of up to 1200 to lower-income workers. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high. Connect With a Fidelity Advisor Today.

Start filing for free online now. March 1 2022 at 838 pm. Washington state Gov.

Taxes capital gains as income and the rate reaches 575. The most common assets that will generate. The sale of stocks bonds and other high-value assets that earns more than 250000 will.

The 2021 Washington State Legislature recently passed a new 7 tax on the sale of long-term capital assets including stocks bonds business interests or other investments. Washington Legislature Approves Capital Gains Tax. Starting in 2022 Washington will apply a 7 tax on realized capital gains above 250000.

Washington State Capital Gains Tax. Inslee proposed in his 2021-23 budget see Gov. AP A judge has overturned a new capital gains tax on high profit stocks bonds and other assets that was approved by the.

Connect With a Fidelity Advisor Today. Idaho axes capital gains as income.

The States With The Highest Capital Gains Tax Rates The Motley Fool

How To Calculate Capital Gains And Losses

Capital Gains Tax Calculator 2022 Casaplorer

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

Navigating Washington State S New Capital Gains Tax Coldstream Wealth Management

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

2021 Capital Gains Tax Rates By State

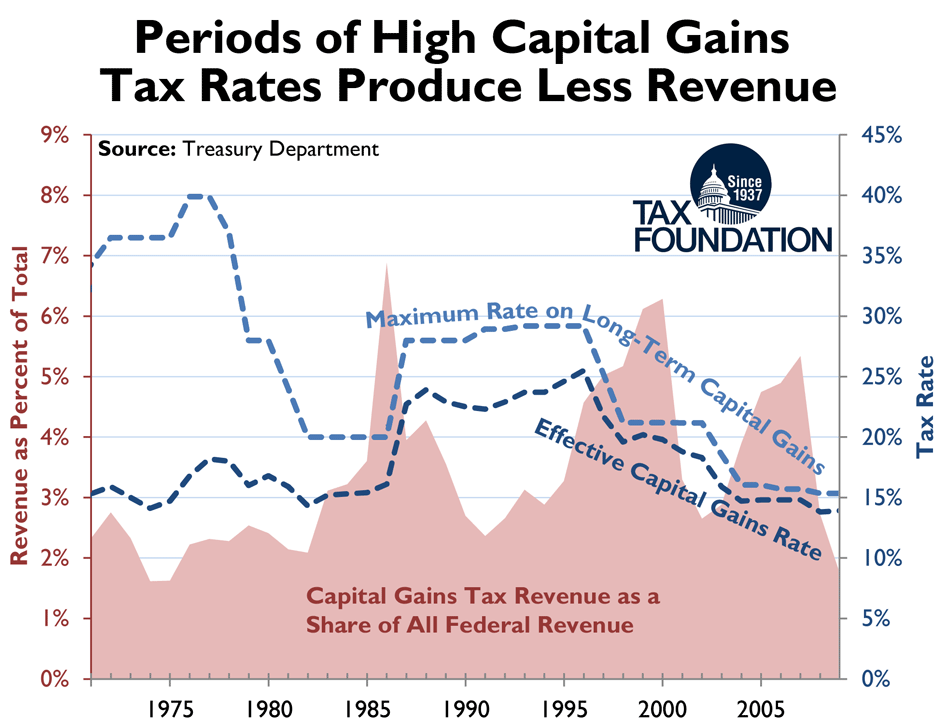

Reagan Showed It Can Be Done Lower The Top Rate To 28 Percent And Raise More Revenue Tax Foundation

Navigating Washington State S New Capital Gains Tax Coldstream Wealth Management

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

Double Taxation Definition Taxedu Tax Foundation

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

2021 Capital Gains Tax Rates By State Smartasset

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Washington State Enacted Capital Gains Tax Currently Held To Be Unconstitutional 2021 Articles Resources Cla Cliftonlarsonallen

Navigating Washington State S New Capital Gains Tax Coldstream Wealth Management